12 min read • Financial services, Operations management

Beyond cost efficiencies in shared service centers

Alternative focus to maximize shared service center value generation

Executive Summary

Centralization, as a means to achieve lower operational costs through economies of scale and less expensive locations, has driven the development of shared service centers. However, at Arthur D. Little we believe shared service centers should be built and operated as sources of value – going well beyond cost efficiencies for organizations. These centers should act as cornerstones for business intelligence, analytics and operational excellence, leveraging key process characteristics and adequate technology to enhance customer satisfaction. This will allow organizations to thrive in a globalized and highly competitive environment, while offering customer-focused services and maximizing overall operational efficiency.

The radical continuous performance improvement of shared service centers

Shared service centers (SSCs) at a glance

The concept of shared services was first used in the late 1980s. Organizations were beginning to realize the need to increase their operating efficiency, and found that clustering similar resources that could serve multiple organizational areas in one place would maximize their productivity and increase service levels. Shared services started with the creation of centers where basic processes – typically back office – were centralized, thoroughly analyzed and optimized through reduction of headcount and elimination of non-critical activities.

As organizations materialized the benefits of such efforts, and the global economy accelerated its development, more innovative approaches surfaced. Corporations identified new opportunities to increase their scale and benefits by creating global business centers in geographies that could provide the necessary talent at lower cost. This translated into a “boom” in adoption of shared services as a core business capability that aimed to maximize cost-efficiencies while providing the necessary service levels and operational excellence.

In recent years, shared service centers have continued to develop, adopting new technologies that increased operating profitability. However, everything has its limit, and new challenges have emerged, given the continuous changes in consumption habits, trends and needs. Competition has also increased and entry barriers have lowered in most industries.

Consumers have become more sophisticated and demanding in how they satisfy their needs. This requires organizations to continue developing their service capabilities so they can maintain their competitive market positioning while developing customer-centric culture. Shared service centers can play a critical role in enabling this, but companies must change their focus and core operations.

Throughout this paper, we will explain an alternative focus for corporations seeking to boost their operational efficiency in an era of digital transformation and emerging technologies. A forceful, competitive landscape will determine whether players perish or triumph. Arthur D. Little will explain how this old-fashioned concept can be disrupted, rather than evolve, throughout our Radical Continuous Performance Improvement methodology. This approach is based on a digital shift, through which radical improvements can be achieved. Key technologies (IoT, AI, Big Data or Cloud Services) are leveraged, and a systematic approach for continuous process improvement is established. Disruptive changes are the transformation engine, with high internal replicability among non-centralized areas.

The evolution of shared service centers

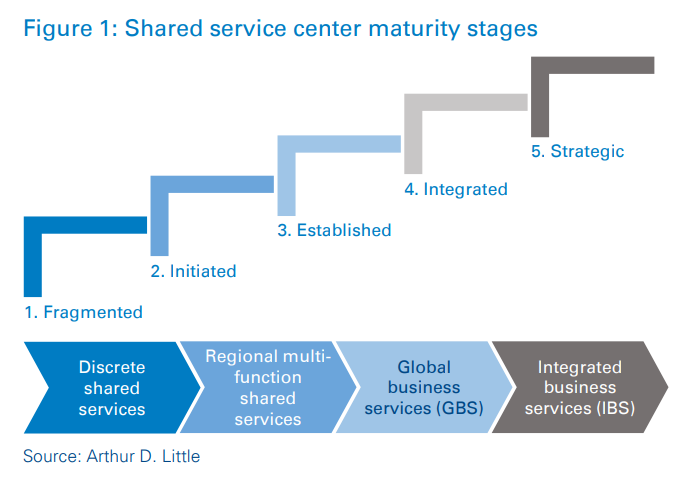

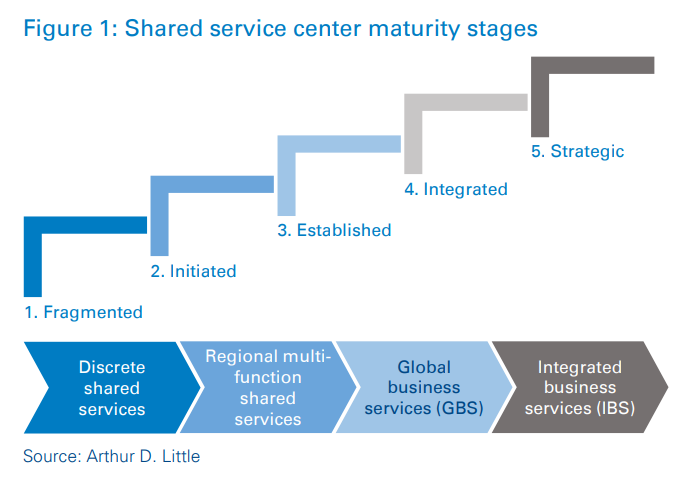

Companies in many industries have developed centralized structures in order to achieve economies of scale and further efficiencies. However, their levels of maturity and complexity of operations vary from plain centralized structures or services to development of integrated business services with respective centers of competence. (See Figure 1.)

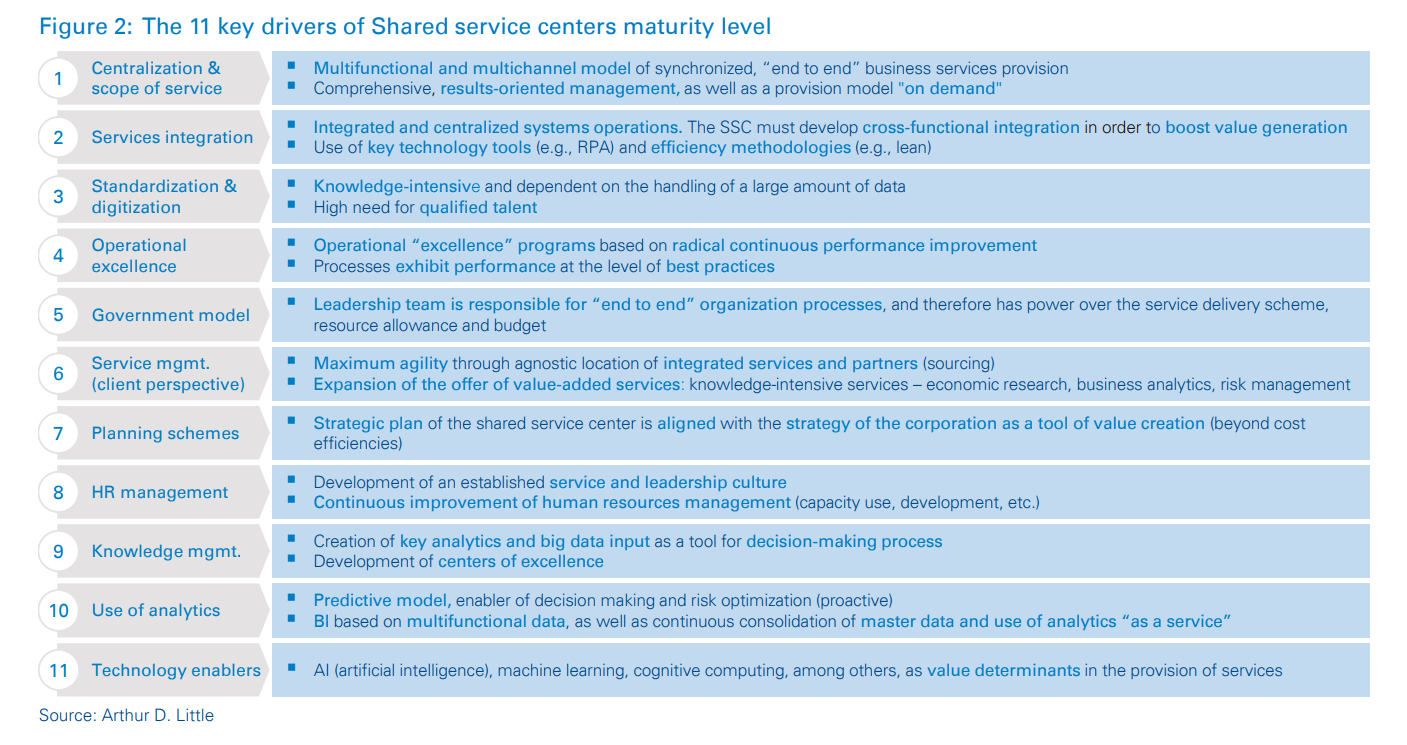

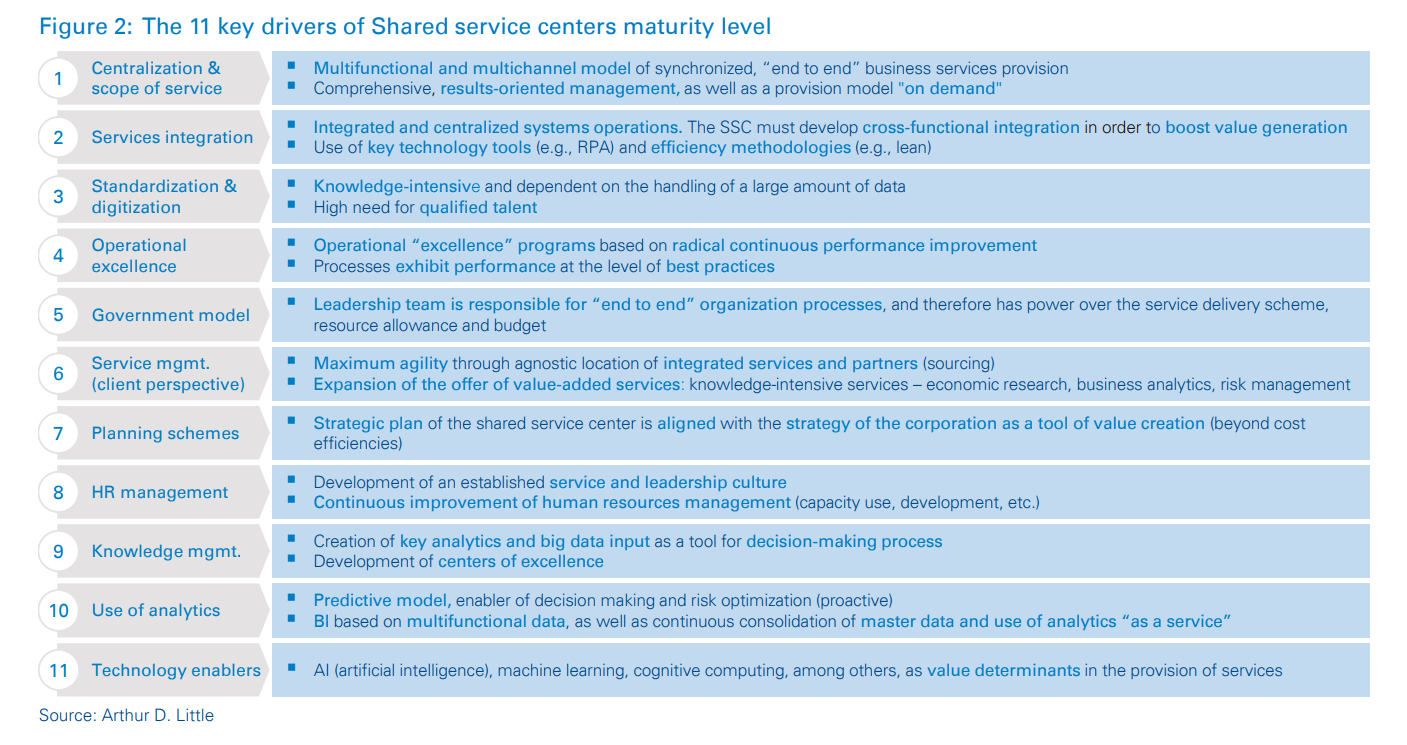

Assessment of the maturity level of a shared service center must consider several key drivers, which will shape potential gaps, competitive positions, and key areas to prioritize for further growth and efficiency gains. These key levers are described as follows in Figure 2.

Key success factors that shape shared service centers

Organizations are continuously looking for new ways to maximize their operations performances, given the never-ending management pressure to improve profitability and shareholder value. Shared service centers play a critical role in achieving this, and thus is important to understand the key trends that will shape how organizations work in the near future:

- Customer-centricity focus – Historically, organizations tended to operate based on internal perspectives, rather than what their customers needed, because customers were less savvy and informed and had limited communication channels. In addition, it is easier to modify what is directly under you control than what is not. All of this has dramatically changed in recent years, as globalization and digital channels have enabled consumers to use and compare a broader range of products and services than they ever could before. Consumers can now give immediate feedback to product and service providers and share it with others through online channels, which can affect the company’s reputation and translate into the success or failure the product or service. Consequently, organizations now face the challenge of putting their customers first and aligning their value propositions with this focus. A wide range of activities need to be adapted, from the core characteristics of their products to the customer service and relationship mechanisms they offer. This increases the relevance of shared service centers.

- Process standardization – Processes are at the core of business operations. They enable interactions between stakeholders to effectively fulfill activities with specific purposes. When processes are consumer facing, they impact product or service satisfaction, which can affect the offering’s revenue generation capacity. Consequently, organizations need to be consistent and coherent as to how they structure and provide their services, as this can demonstrate a key differentiating capability from those of competitors. Processes have different standardization capacities, and this needs to be clearly understood when defining whether and how these services should operate through shared service centers. Organizations must be able to understand how each of their processes are embedded throughout, and given their specific nature, make the required decisions for those processes to operate optimally. This is no simple task, as it is common for stakeholders to have different perceptions of the processes’ nature. In turn, it will impact the way those processes are structured and built into shared service centers – and, consequently, how they affect the overall result (either internal or external).

- Technology as a driver – Technology has developed at an unprecedented rate, translating into a constant flow of new and more innovative discoveries that have impacted businesses one way or another. Shared service centers are continuously surrounded by new technologies that affect how they function and service their business needs. This forces managers to make decisions regarding how and where to adopt such technologies. The trend will continue to modify the core of shared service centers, and requires clear understanding of their functionality, benefits, risks and adoption challenges. Leaders in charge of shared services need to learn how to be critical of new technologies, as well as build and integrate them into their operations in ways that enhance benefits rather than disrupt them.

Shared Service Centers as a Key Business Differentiator

As mentioned before, most shared service centers aim to develop process efficiencies through economies of scale or cost reductions via relocation of operations (savings through migration to locations with lower labor/tax costs) and operating efficiencies. Nevertheless, there is plenty of room to grasp additional benefits through use of these centers as business enhancers, through customer-centric focus, process standardization and adopting technology as a driver.

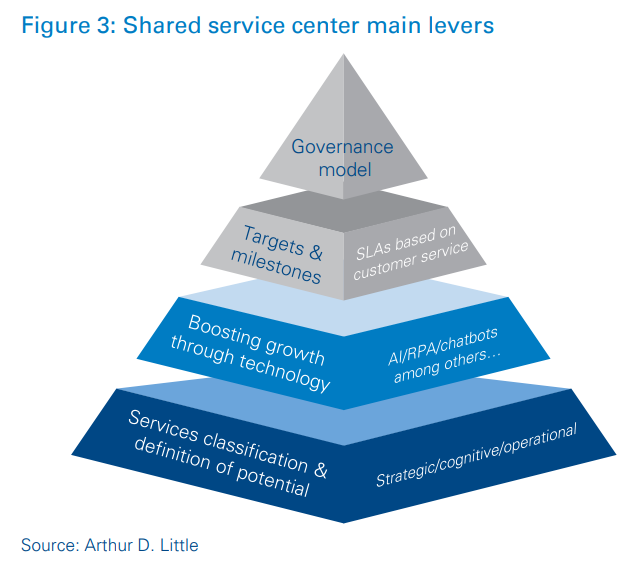

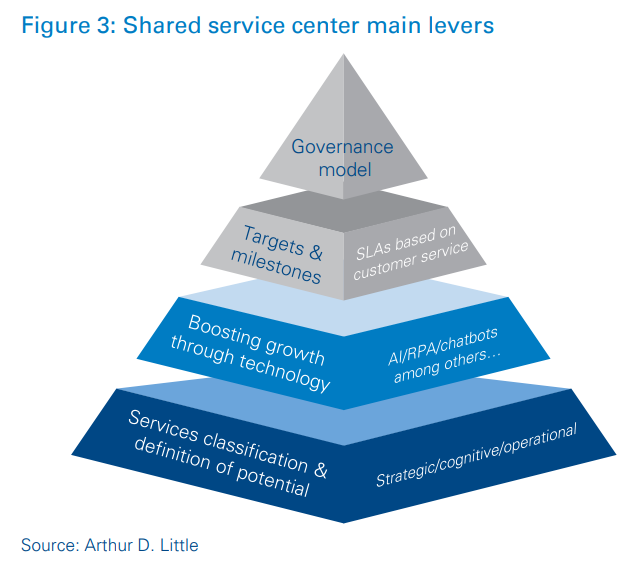

To maximize potential, organizations need to focus on four main levers (Figure 3) when defining and constructing their shared service models.

1. Service classification & definition of potential

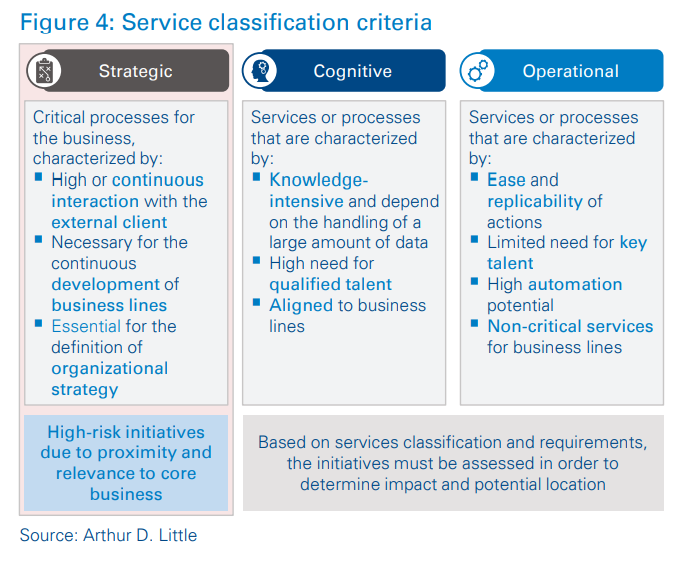

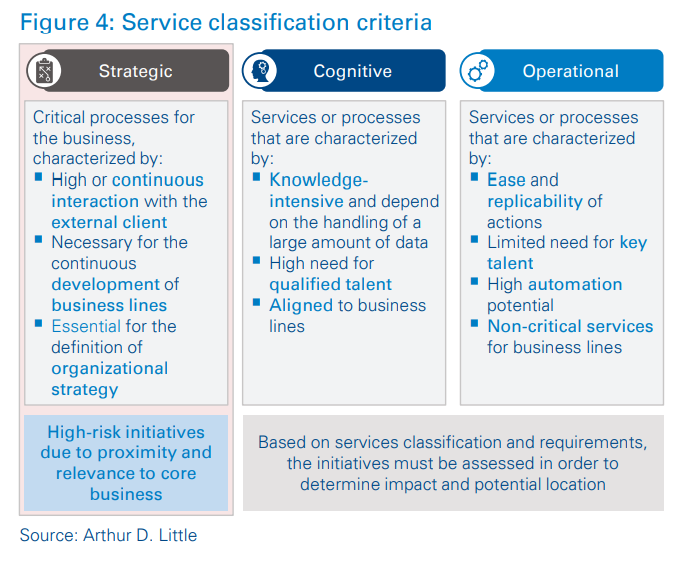

When evaluating and defining services that could operate under a shared service center model, management needs to identify the nature of each service and classify it into three main segments: strategic, cognitive and operational services (Figure 4)

Strategic services are those that require on-site interactions with end customers, and thus understanding and knowledge of the local market. Given its relevance and lack of standardization potential, these services are not good candidates for centralization. Incorporating strategic services into an SSC structure will represent a potential risk for the organization and a shortage in efficiencies (longer decision making-periods and agility among organizations) due to lack of synergies between regions.

Arthur D. Little has classified services that require interactions with both internal and external clients, including decision-making processes focused on execution of strategies rather than their development and present synergy opportunities between regions, as cognitive services. Cognitive services tend to have the biggest potential as enablers of customer-centric cultures, and are the main suppliers of benefits beyond costs. However, they require more specific human resources to unlock the necessary efficiencies and value creation capacity.

Finally, operational services refer to those with low or no decision-making requirements and lots of repetition. Operational services follow predefined scripts or tasks with no expected variation through time. Most traditional shared services prioritize these services due to their potential for standardization/ automation and replicability, which promise economies of scale and efficiencies. Furthermore, operational services have limited need for knowledge, and therefore are good candidates for migration to more cost-effective geographies.

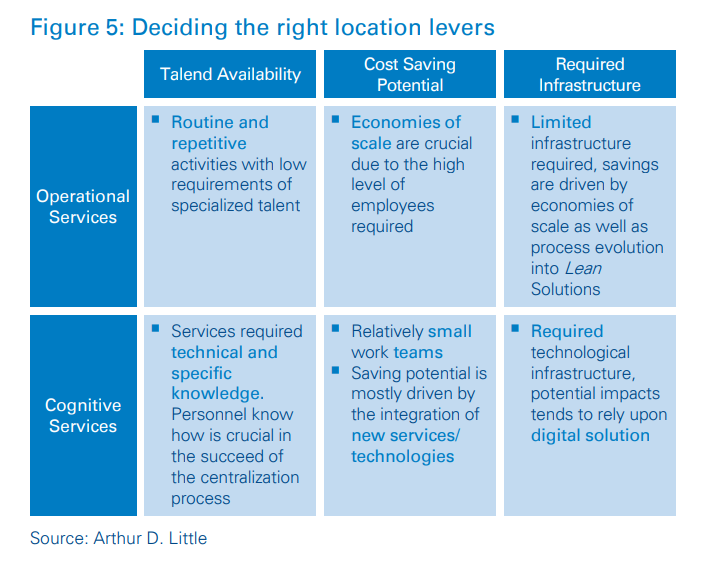

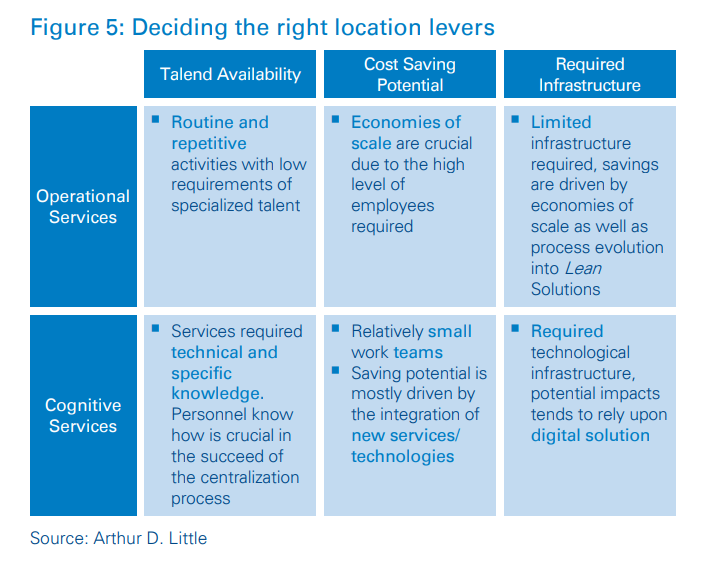

After the initial service classification, it is necessary to consider the impact that location will have on the shared service center. To do so, certain key variables need to be analyzed, such as talent availability, cost arbitrage and required infrastructure. These variables apply for both operational and cognitive services; however, the characteristics in Figure 5 also need to be considered. For example, operational services tend to prefer locations with the most cost-saving potential (low labor cost, attractive fiscal tax scheme, etc.), whereas cognitive services tend to value talent availability over cost savings, primarily due to technical and knowledge-specific requirements.

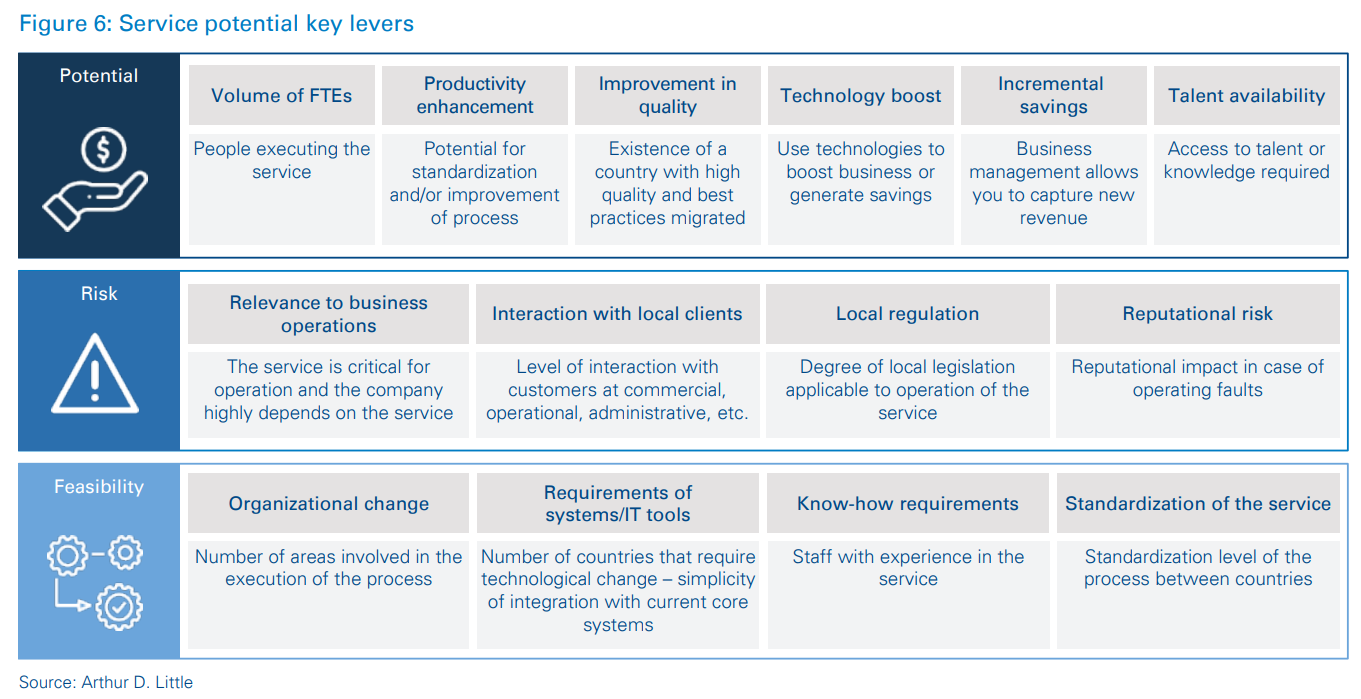

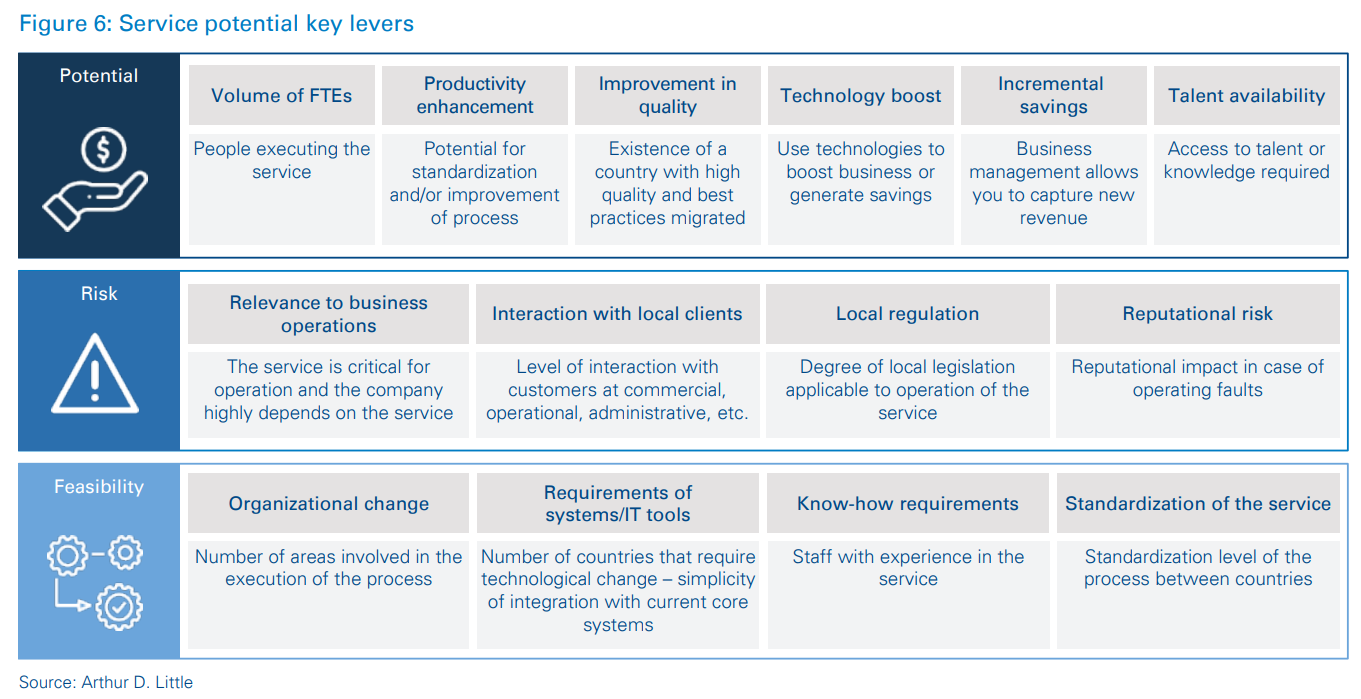

Once services are classified accordingly (strategic, cognitive and operational) and potential SSC locations are identified, managers should quantify the expected impact, potential risks (i.e., migrate operations to a centralized structure) and feasibility of implementation – all with important criteria. (See Figure 6.)

Service classification – illustrative

Strategic:

- Innovation and operational strategy for physical and digital channels

- Marketing & advertisement

- Lead generation

- Definition of remuneration schemes

- Go-to-market strategy definition

Cognitive:

- Purchase to invoice

- Treasury/markets

- Contact centers (inbound & outbound)

- IT architecture

- Platform/software development

Operational:

- Network management

- Invoice to pay

- Digital contact center

- Client data management

- Employee onboarding/offboarding

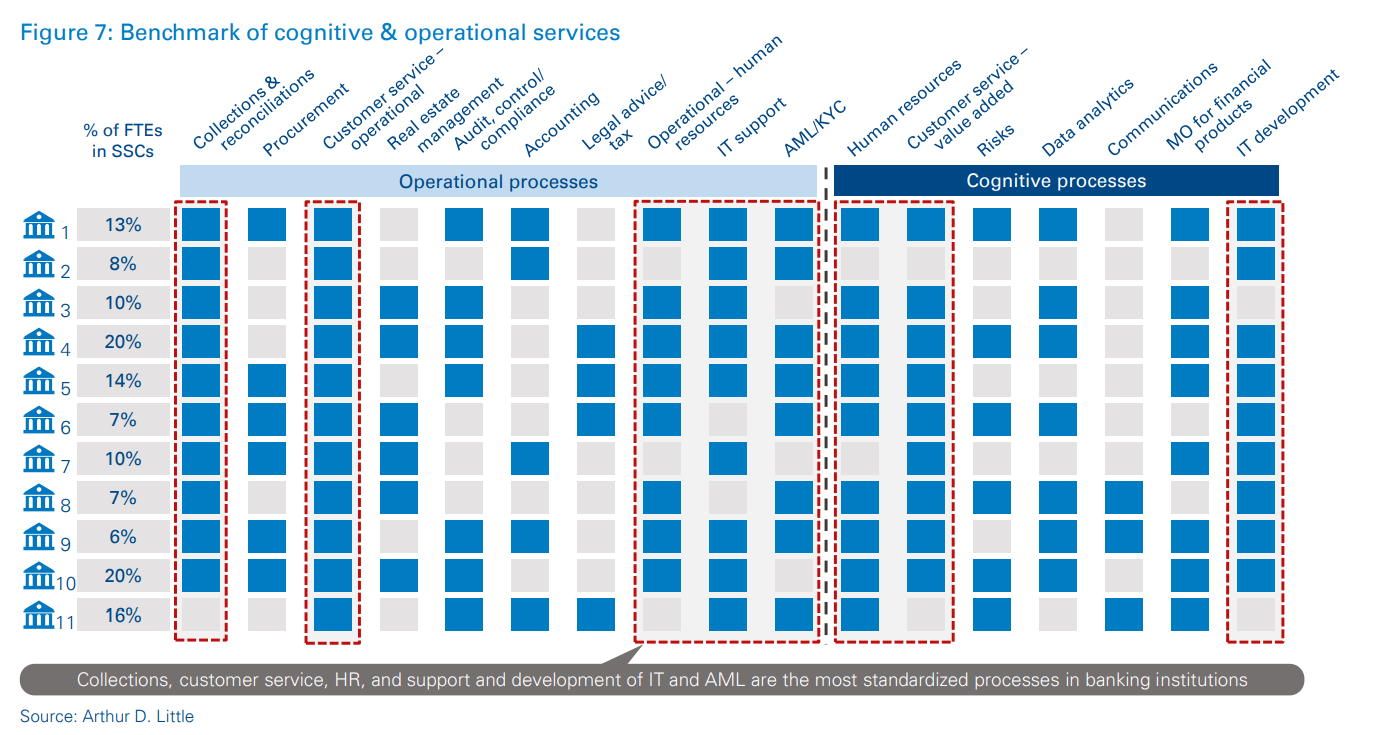

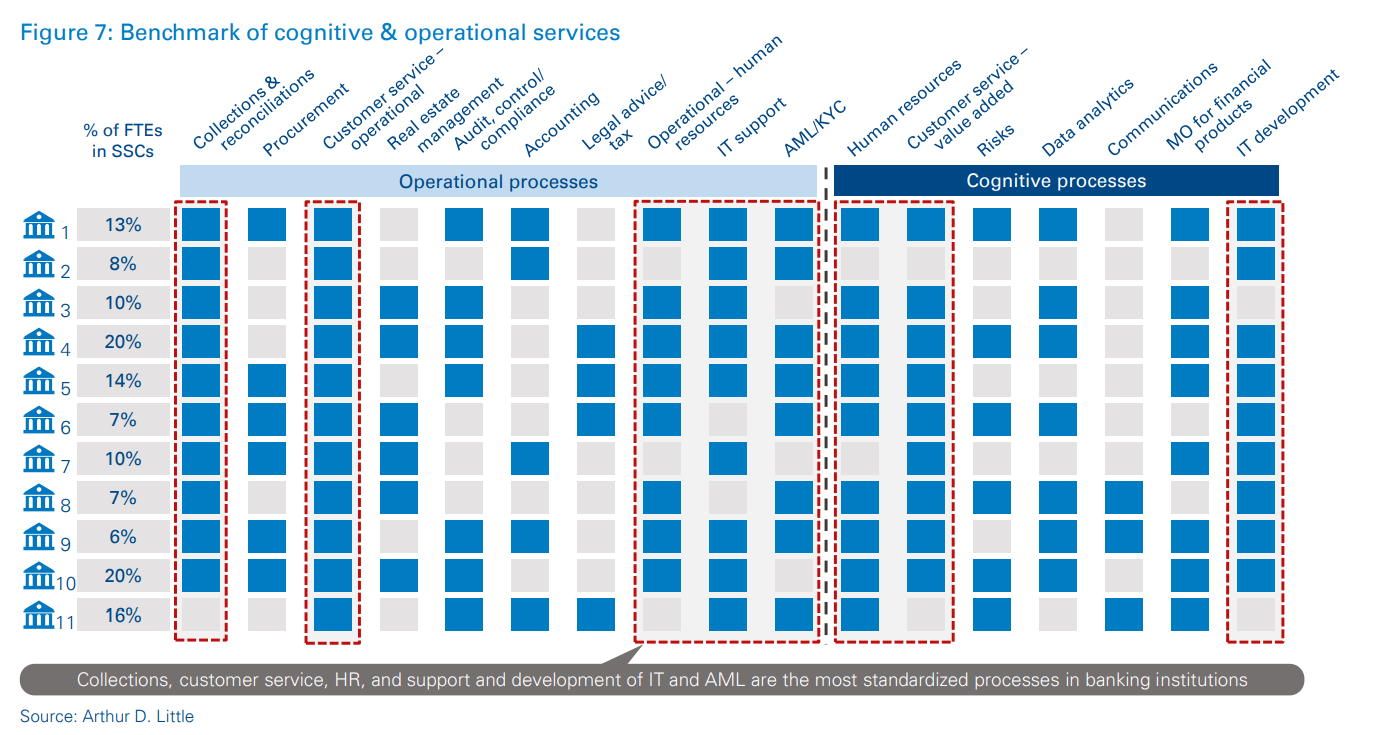

It is important to consider that no one size fits all shared service initiatives. Based on their industries or strategic roadmaps, companies tend to prioritize a wide range of services. A typical example occurs in the financial service industry, in which companies pursue different goals. (Some of them are oriented towards retail banking, while others tend to use a corporate service approach.) They therefore prioritize different initiatives, as highlighted in the non-exhaustive benchmark in Figure 7.

2. Boosting growth through technology

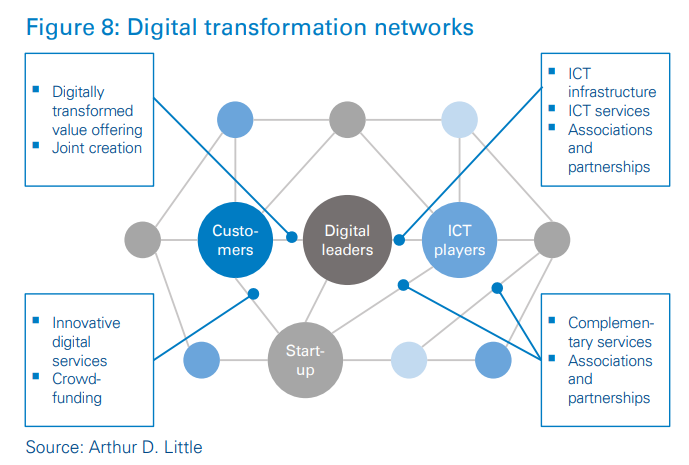

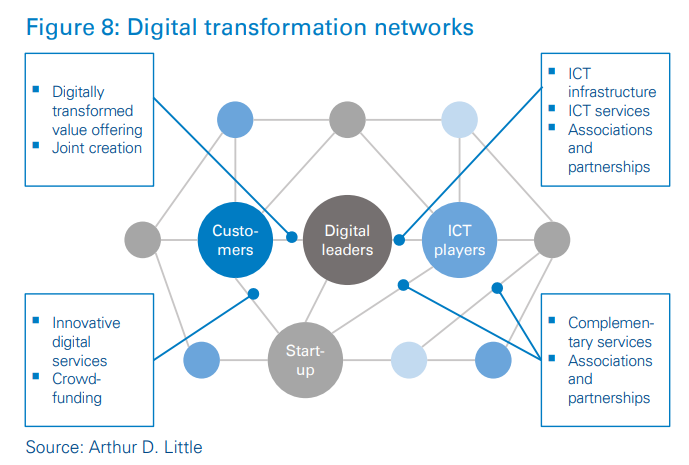

Technology is a key lever that has become increasingly relevant to maximizing value generation potential for SSCs. Organizations that adopt new technologies are continuously forming value networks with customers, ICT players and start-ups to develop new capabilities and deliver increased value. (See Figure 8.)

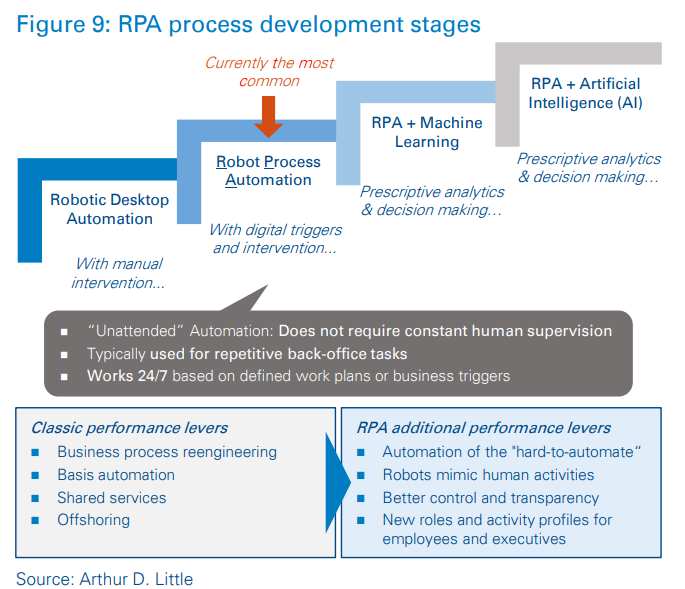

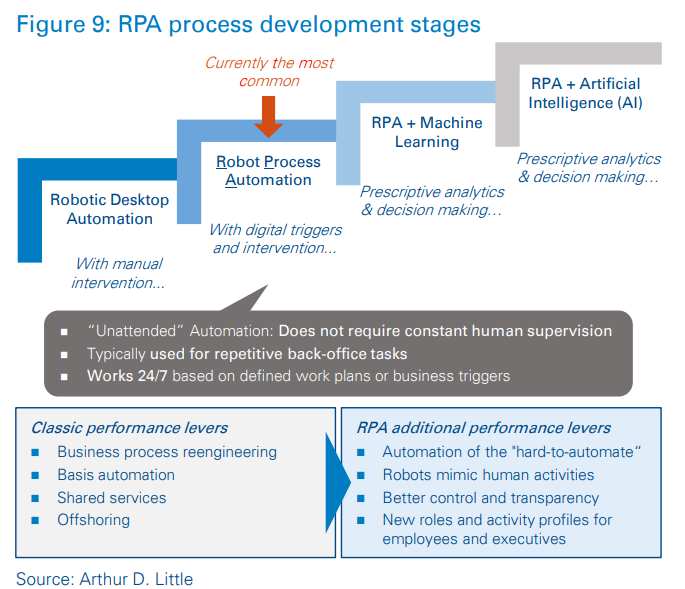

Specifically, robotic process automation (RPA) has become a key component of SSC operations. We have defined three development stages of RPA:

- Rule-based robotics in single processes – Employees have single repetitive processes performed by bots, such as data handling between payroll and accounting processes.

- Rule-based robotics end to end – Bots conduct complete connected work processes and become “virtual workers”. Employees monitor and control these processes, intervening when necessary. An example is the use of chatbots for interactions through online and digital channels.

- Cognitive automation – Bots independently start tasks and make fact-based decisions. An example involves predictive calling in contact centers, in which bots quantify each customer’s potential for product cross-selling based on transactional information, and generate leads that show the highest probability of success.

RPA is and will continue to be one of the most relevant digital technologies, given its impact on cost savings and efficiency. Hyped as the new method for improving performance in administrative areas, RPA offers a full range of opportunities to increase business potential.

3. Targets and milestone

Prior to migration of services into a shared service center structure, it is crucial that certain milestones and targets are defined. This ensures adequate transition and operation for both the SSC responsible and the local operating areas. As a result, service-level agreements (SLAs) need be developed and structured based on the following general components:

- Efficiency: Clear understanding of where the value of each service will come from under the SSC structure. This can be efficiency, revenue generation or quality of service.

- Trust and reliability: The SSC needs to be defined as a reliable source of information and time-effective solution. Centralization should boost response times for both internal and external clients, ensuring reliability beyond cost efficiencies (i.e., time to resolution, availability of service).

- Risk control: Management of all potential risks during migration and operation of the service, through implementation of controls and contingency mechanisms.

- People management: Hiring and retention of key talent for the SSC operations will generate lower operational costs for the SSC’s profit and loss, and make achieving additional benefits easier.

In general, the defined target and milestones for transition and operation of services under an SSC structure will set the guidelines and limits. They will also enable adequate monitoring and adjustment as required. A sufficient definition of SLAs is key to ensuring that results are aligned to overall management expectations.

4. Governance model

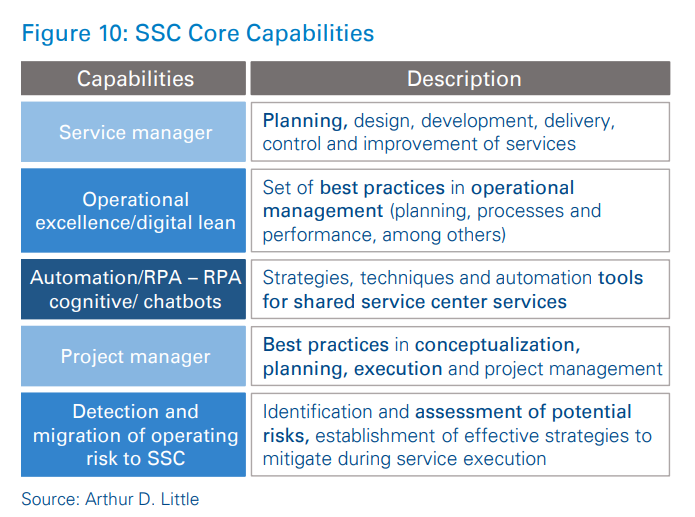

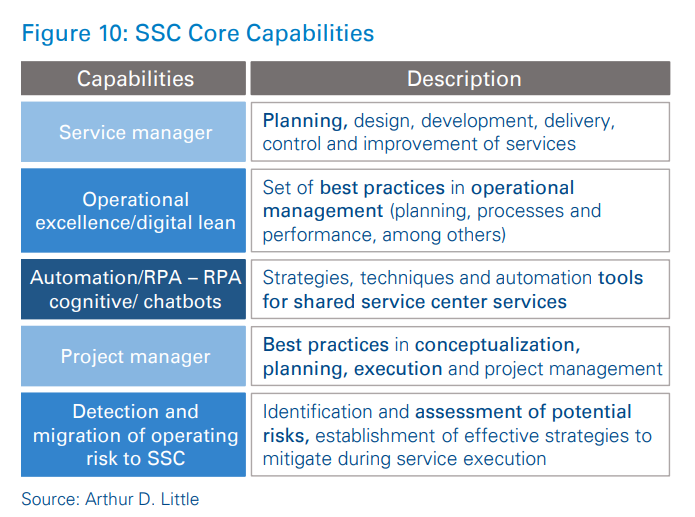

Finally, it is crucial to structure a governance model that supports the success of the shared service center. Based on Arthur D. Little’s project experience, there isn’t a one-size-fits-all organizational design approach. This is because of the synergies and skills required to manage the potential service, which must be incorporated into a centralized structure. (Services must be clustered according to their business units.) Nevertheless, crucial capabilities must be included as part of a centralized structure, as shown in Figure 10.

In addition to these capabilities, incorporation of three support units for managers can create additional and faster savings for the organization, as well as smoother operation of those services already under the SSC business model:

- Administrative – Responsible for separating service administration from local managers with SSC operations.

Administrative support’s main tasks include:

- Management of SSC location and contract management

- Billing of services to countries and accounting of the SSC

- The expense budget

- Management of support personnel (cleaning, access, etc.)

- Sizing of the current unit with an accounting analyst to free up management of business operations

- Planning & measuring – Responsible for operations planning and SSC information management. Planning & measuring support’s main tasks include:

- Operation planning (demand and capacity management)

- Monitoring of SLAs and reporting (internal and external)

- Reception and resolution of country claims

- Risk management and continuity

- Generation of monthly analyses and reports, as well as multifunctional profiles

- Operational excellence – The project manager is responsible for continuous operations improvements. Operational excellence support’s main tasks include:

- Project management

- Optimization of processes

- Process automation and RPA

- Services migration processes

Conclusion – Striving for success

Maximizing the performance of an SSC is not an easy process. It usually faces several challenges within the organization. First, it requires adequate alignment and understanding among the leadership of the organization, as this affects their day-to-day activities and implies taking several risks. In addition, adoption and development of key levers is a time-intensive process, from identification and evaluation of processes to analyses of available technology and required infrastructure. Moreover, there will always be uncertainty during the execution, particularly when using new technology. A progressive, pilot-based approach is often necessary for new technology as the organization learns how to make the best use of it. Finally, optimizing the SSC may require certain investments to ensure correct execution of operations.

At Arthur D. Little we understand how demanding optimizing an SSC can be, and have developed a set of methodologies and frameworks. These enable an organized and adequate pace to develop the required capabilities and extract the highest value from services in centers. We have experience of developing SSCs across different types of industries and geographies, and know the particularities that each faces. That is why we work “side by side” with our clients and guide them through the entire process, while leveraging our global resources and scale.

DOWNLOAD THE FULL REPORT

12 min read • Financial services, Operations management

Beyond cost efficiencies in shared service centers

Alternative focus to maximize shared service center value generation

DATE

Executive Summary

Centralization, as a means to achieve lower operational costs through economies of scale and less expensive locations, has driven the development of shared service centers. However, at Arthur D. Little we believe shared service centers should be built and operated as sources of value – going well beyond cost efficiencies for organizations. These centers should act as cornerstones for business intelligence, analytics and operational excellence, leveraging key process characteristics and adequate technology to enhance customer satisfaction. This will allow organizations to thrive in a globalized and highly competitive environment, while offering customer-focused services and maximizing overall operational efficiency.

The radical continuous performance improvement of shared service centers

Shared service centers (SSCs) at a glance

The concept of shared services was first used in the late 1980s. Organizations were beginning to realize the need to increase their operating efficiency, and found that clustering similar resources that could serve multiple organizational areas in one place would maximize their productivity and increase service levels. Shared services started with the creation of centers where basic processes – typically back office – were centralized, thoroughly analyzed and optimized through reduction of headcount and elimination of non-critical activities.

As organizations materialized the benefits of such efforts, and the global economy accelerated its development, more innovative approaches surfaced. Corporations identified new opportunities to increase their scale and benefits by creating global business centers in geographies that could provide the necessary talent at lower cost. This translated into a “boom” in adoption of shared services as a core business capability that aimed to maximize cost-efficiencies while providing the necessary service levels and operational excellence.

In recent years, shared service centers have continued to develop, adopting new technologies that increased operating profitability. However, everything has its limit, and new challenges have emerged, given the continuous changes in consumption habits, trends and needs. Competition has also increased and entry barriers have lowered in most industries.

Consumers have become more sophisticated and demanding in how they satisfy their needs. This requires organizations to continue developing their service capabilities so they can maintain their competitive market positioning while developing customer-centric culture. Shared service centers can play a critical role in enabling this, but companies must change their focus and core operations.

Throughout this paper, we will explain an alternative focus for corporations seeking to boost their operational efficiency in an era of digital transformation and emerging technologies. A forceful, competitive landscape will determine whether players perish or triumph. Arthur D. Little will explain how this old-fashioned concept can be disrupted, rather than evolve, throughout our Radical Continuous Performance Improvement methodology. This approach is based on a digital shift, through which radical improvements can be achieved. Key technologies (IoT, AI, Big Data or Cloud Services) are leveraged, and a systematic approach for continuous process improvement is established. Disruptive changes are the transformation engine, with high internal replicability among non-centralized areas.

The evolution of shared service centers

Companies in many industries have developed centralized structures in order to achieve economies of scale and further efficiencies. However, their levels of maturity and complexity of operations vary from plain centralized structures or services to development of integrated business services with respective centers of competence. (See Figure 1.)

Assessment of the maturity level of a shared service center must consider several key drivers, which will shape potential gaps, competitive positions, and key areas to prioritize for further growth and efficiency gains. These key levers are described as follows in Figure 2.

Key success factors that shape shared service centers

Organizations are continuously looking for new ways to maximize their operations performances, given the never-ending management pressure to improve profitability and shareholder value. Shared service centers play a critical role in achieving this, and thus is important to understand the key trends that will shape how organizations work in the near future:

- Customer-centricity focus – Historically, organizations tended to operate based on internal perspectives, rather than what their customers needed, because customers were less savvy and informed and had limited communication channels. In addition, it is easier to modify what is directly under you control than what is not. All of this has dramatically changed in recent years, as globalization and digital channels have enabled consumers to use and compare a broader range of products and services than they ever could before. Consumers can now give immediate feedback to product and service providers and share it with others through online channels, which can affect the company’s reputation and translate into the success or failure the product or service. Consequently, organizations now face the challenge of putting their customers first and aligning their value propositions with this focus. A wide range of activities need to be adapted, from the core characteristics of their products to the customer service and relationship mechanisms they offer. This increases the relevance of shared service centers.

- Process standardization – Processes are at the core of business operations. They enable interactions between stakeholders to effectively fulfill activities with specific purposes. When processes are consumer facing, they impact product or service satisfaction, which can affect the offering’s revenue generation capacity. Consequently, organizations need to be consistent and coherent as to how they structure and provide their services, as this can demonstrate a key differentiating capability from those of competitors. Processes have different standardization capacities, and this needs to be clearly understood when defining whether and how these services should operate through shared service centers. Organizations must be able to understand how each of their processes are embedded throughout, and given their specific nature, make the required decisions for those processes to operate optimally. This is no simple task, as it is common for stakeholders to have different perceptions of the processes’ nature. In turn, it will impact the way those processes are structured and built into shared service centers – and, consequently, how they affect the overall result (either internal or external).

- Technology as a driver – Technology has developed at an unprecedented rate, translating into a constant flow of new and more innovative discoveries that have impacted businesses one way or another. Shared service centers are continuously surrounded by new technologies that affect how they function and service their business needs. This forces managers to make decisions regarding how and where to adopt such technologies. The trend will continue to modify the core of shared service centers, and requires clear understanding of their functionality, benefits, risks and adoption challenges. Leaders in charge of shared services need to learn how to be critical of new technologies, as well as build and integrate them into their operations in ways that enhance benefits rather than disrupt them.

Shared Service Centers as a Key Business Differentiator

As mentioned before, most shared service centers aim to develop process efficiencies through economies of scale or cost reductions via relocation of operations (savings through migration to locations with lower labor/tax costs) and operating efficiencies. Nevertheless, there is plenty of room to grasp additional benefits through use of these centers as business enhancers, through customer-centric focus, process standardization and adopting technology as a driver.

To maximize potential, organizations need to focus on four main levers (Figure 3) when defining and constructing their shared service models.

1. Service classification & definition of potential

When evaluating and defining services that could operate under a shared service center model, management needs to identify the nature of each service and classify it into three main segments: strategic, cognitive and operational services (Figure 4)

Strategic services are those that require on-site interactions with end customers, and thus understanding and knowledge of the local market. Given its relevance and lack of standardization potential, these services are not good candidates for centralization. Incorporating strategic services into an SSC structure will represent a potential risk for the organization and a shortage in efficiencies (longer decision making-periods and agility among organizations) due to lack of synergies between regions.

Arthur D. Little has classified services that require interactions with both internal and external clients, including decision-making processes focused on execution of strategies rather than their development and present synergy opportunities between regions, as cognitive services. Cognitive services tend to have the biggest potential as enablers of customer-centric cultures, and are the main suppliers of benefits beyond costs. However, they require more specific human resources to unlock the necessary efficiencies and value creation capacity.

Finally, operational services refer to those with low or no decision-making requirements and lots of repetition. Operational services follow predefined scripts or tasks with no expected variation through time. Most traditional shared services prioritize these services due to their potential for standardization/ automation and replicability, which promise economies of scale and efficiencies. Furthermore, operational services have limited need for knowledge, and therefore are good candidates for migration to more cost-effective geographies.

After the initial service classification, it is necessary to consider the impact that location will have on the shared service center. To do so, certain key variables need to be analyzed, such as talent availability, cost arbitrage and required infrastructure. These variables apply for both operational and cognitive services; however, the characteristics in Figure 5 also need to be considered. For example, operational services tend to prefer locations with the most cost-saving potential (low labor cost, attractive fiscal tax scheme, etc.), whereas cognitive services tend to value talent availability over cost savings, primarily due to technical and knowledge-specific requirements.

Once services are classified accordingly (strategic, cognitive and operational) and potential SSC locations are identified, managers should quantify the expected impact, potential risks (i.e., migrate operations to a centralized structure) and feasibility of implementation – all with important criteria. (See Figure 6.)

Service classification – illustrative

Strategic:

- Innovation and operational strategy for physical and digital channels

- Marketing & advertisement

- Lead generation

- Definition of remuneration schemes

- Go-to-market strategy definition

Cognitive:

- Purchase to invoice

- Treasury/markets

- Contact centers (inbound & outbound)

- IT architecture

- Platform/software development

Operational:

- Network management

- Invoice to pay

- Digital contact center

- Client data management

- Employee onboarding/offboarding

It is important to consider that no one size fits all shared service initiatives. Based on their industries or strategic roadmaps, companies tend to prioritize a wide range of services. A typical example occurs in the financial service industry, in which companies pursue different goals. (Some of them are oriented towards retail banking, while others tend to use a corporate service approach.) They therefore prioritize different initiatives, as highlighted in the non-exhaustive benchmark in Figure 7.

2. Boosting growth through technology

Technology is a key lever that has become increasingly relevant to maximizing value generation potential for SSCs. Organizations that adopt new technologies are continuously forming value networks with customers, ICT players and start-ups to develop new capabilities and deliver increased value. (See Figure 8.)

Specifically, robotic process automation (RPA) has become a key component of SSC operations. We have defined three development stages of RPA:

- Rule-based robotics in single processes – Employees have single repetitive processes performed by bots, such as data handling between payroll and accounting processes.

- Rule-based robotics end to end – Bots conduct complete connected work processes and become “virtual workers”. Employees monitor and control these processes, intervening when necessary. An example is the use of chatbots for interactions through online and digital channels.

- Cognitive automation – Bots independently start tasks and make fact-based decisions. An example involves predictive calling in contact centers, in which bots quantify each customer’s potential for product cross-selling based on transactional information, and generate leads that show the highest probability of success.

RPA is and will continue to be one of the most relevant digital technologies, given its impact on cost savings and efficiency. Hyped as the new method for improving performance in administrative areas, RPA offers a full range of opportunities to increase business potential.

3. Targets and milestone

Prior to migration of services into a shared service center structure, it is crucial that certain milestones and targets are defined. This ensures adequate transition and operation for both the SSC responsible and the local operating areas. As a result, service-level agreements (SLAs) need be developed and structured based on the following general components:

- Efficiency: Clear understanding of where the value of each service will come from under the SSC structure. This can be efficiency, revenue generation or quality of service.

- Trust and reliability: The SSC needs to be defined as a reliable source of information and time-effective solution. Centralization should boost response times for both internal and external clients, ensuring reliability beyond cost efficiencies (i.e., time to resolution, availability of service).

- Risk control: Management of all potential risks during migration and operation of the service, through implementation of controls and contingency mechanisms.

- People management: Hiring and retention of key talent for the SSC operations will generate lower operational costs for the SSC’s profit and loss, and make achieving additional benefits easier.

In general, the defined target and milestones for transition and operation of services under an SSC structure will set the guidelines and limits. They will also enable adequate monitoring and adjustment as required. A sufficient definition of SLAs is key to ensuring that results are aligned to overall management expectations.

4. Governance model

Finally, it is crucial to structure a governance model that supports the success of the shared service center. Based on Arthur D. Little’s project experience, there isn’t a one-size-fits-all organizational design approach. This is because of the synergies and skills required to manage the potential service, which must be incorporated into a centralized structure. (Services must be clustered according to their business units.) Nevertheless, crucial capabilities must be included as part of a centralized structure, as shown in Figure 10.

In addition to these capabilities, incorporation of three support units for managers can create additional and faster savings for the organization, as well as smoother operation of those services already under the SSC business model:

- Administrative – Responsible for separating service administration from local managers with SSC operations.

Administrative support’s main tasks include:

- Management of SSC location and contract management

- Billing of services to countries and accounting of the SSC

- The expense budget

- Management of support personnel (cleaning, access, etc.)

- Sizing of the current unit with an accounting analyst to free up management of business operations

- Planning & measuring – Responsible for operations planning and SSC information management. Planning & measuring support’s main tasks include:

- Operation planning (demand and capacity management)

- Monitoring of SLAs and reporting (internal and external)

- Reception and resolution of country claims

- Risk management and continuity

- Generation of monthly analyses and reports, as well as multifunctional profiles

- Operational excellence – The project manager is responsible for continuous operations improvements. Operational excellence support’s main tasks include:

- Project management

- Optimization of processes

- Process automation and RPA

- Services migration processes

Conclusion – Striving for success

Maximizing the performance of an SSC is not an easy process. It usually faces several challenges within the organization. First, it requires adequate alignment and understanding among the leadership of the organization, as this affects their day-to-day activities and implies taking several risks. In addition, adoption and development of key levers is a time-intensive process, from identification and evaluation of processes to analyses of available technology and required infrastructure. Moreover, there will always be uncertainty during the execution, particularly when using new technology. A progressive, pilot-based approach is often necessary for new technology as the organization learns how to make the best use of it. Finally, optimizing the SSC may require certain investments to ensure correct execution of operations.

At Arthur D. Little we understand how demanding optimizing an SSC can be, and have developed a set of methodologies and frameworks. These enable an organized and adequate pace to develop the required capabilities and extract the highest value from services in centers. We have experience of developing SSCs across different types of industries and geographies, and know the particularities that each faces. That is why we work “side by side” with our clients and guide them through the entire process, while leveraging our global resources and scale.

DOWNLOAD THE FULL REPORT